Is Your Business Entitled to Incredible Tax Breaks For Staff Members You Are Already Hiring?

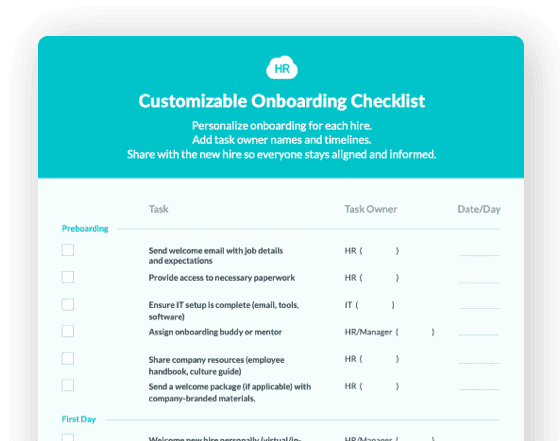

Cut onboarding time

by 60%—here's the

Ultimate Checklist

that helped do it.

Cut onboarding time

by 60%—here's the

Ultimate Checklist

that helped do it.

Ever feel like you’re overpaying on your company’s federal income taxes? Well, you just might be… The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to businesses who employ people from specific target groups and could be worth up to hundreds of thousands of dollars annually.

Research indicates that 10% - 20% of an average company’s workforce would have been eligible for the WOTC program without employers making any changes to personnel or their recruitment process. Meaning, if you’re not currently taking advantage of the WOTC, you’re leaving money on the table.

Read on to discover more about the WOTC and if it can benefit your company.

Who is Eligible for WOTC

As an business owner, you want highly qualified staff members on your team; employees who know what they’re doing and work hard. And if you can save money while employing them? All the better!

Most businesses are unaware that many workers they’ve already hired could entitle them to anywhere from $2,400 - $9,600 in tax breaks per employee. Since 1996, the federal government has endeavored to reward companies for employing people in certain target groups with the WOTC. But what “groups” do your employees need to be in to qualify?

Unemployed Veterans:

Men and women who have served our country often possess skills and training in a wide variety of areas that may prove beneficial to your business. They may also be available for WOTC.

If a veteran is a member of a family who received SNAP benefits for any three-month period during the 15 months prior to being hired or is disabled and entitled to compensation for a service related disability, they are more than likely eligible for WOTC.

Short-Term TANF Recipients:

This group is defined as those who are part of a family that’s received TANF (temporary assistance for needy families) for nine months during the 18 months before they were hired by your company.

SNAP Recipients:

SNAP is the abbreviation for Supplemental Nutrition Assistance Program. If your new employee is between the ages of 18 and 39 and they have received SNAP benefits for six months ending on the date you hire them or for at least three out of the five months prior to your company hiring them, they are eligible for WOTC.

Designated Community Residents:

These residents are defined by the federal government as someone between the ages of 18 and 39 and reside in a federally designated rural renewal county or empowerment zone.

Vocational Rehabilitation:

This group encompasses people with a disability of some kind who’ve completed rehabilitative services from a state-certified agency, Ticket to Work, or the U.S. Department of Veteran Affairs.

Ex-Felons:

Your business can receive a WOTC if you hire someone convicted of a felony within one year of their conviction or release from prison.

SSI Recipient:

To qualify, the SSI recipient must have received SSI benefits for at least one out of two months prior to you hiring them.

Summer Youth Employee

You can also earn WOTC tax credits by hiring summer employees who are 16 to 17 years of age, live in an empowerment zone, and will work for you between May 1 and September 15.

Qualified Long-Term Unemployment Recipient:

This group is defined as those who have been unemployed for 27 weeks, the minimum 27 weeks must be 27 consecutive weeks, leading up to the day the new hire completes their form IRS 8850 and have received compensation under state or federal laws.

It’s also worth reinforcing the fact that many of your current employees would have been eligible for WOTC. Every candidate you hire in the future, should they fall into any of the above categories, can also enable your company to apply for and receive the tax credits.

For more information on the WOTC process and how it could benefit your business, contact us here.

HR Cloud is a leading developer of HR software & HRMS solutions for small and medium size businesses that have high turnover. HR Cloud's Onboard is market leading technology for effective new hire onboarding and Workmates enables employee engagement simply and easily. Founded in 2012, our HRIS empowers teams to easily onboard new hires, manage employee data, create a company social network and support employee development.

Keep Reading

AI for Frontline HR: Moving Beyond Sentiment Analysis to Build Tomorrow's Workforce Management Engine

TL;DR: While most organizations limit artificial intelligence in human resources to basic

Best HR Tools for Compliance Automation (and Why HR Cloud Leads the Pack)

The Compliance Catch-Up: What HR Needs to Fix Before Mid-Year Audits

By May, most HR teams have settled into the rhythm of the year. But compliance? That

Like What You Hear?

We'd love to chat with you more about how HR Cloud® can support your business's HR needs. Book Your Free Demo

Build a Culture of Recognition. Boost Engagement. Guaranteed.

Workmates empowers employees to stay informed, connected, and appreciated—whether they’re on the front line, in the office, or remote. Recognition drives 12x higher engagement.Trusted by industry leaders in every sector

Cut Onboarding Costs by 60%.

Take the confusion and follow-ups out of onboarding with automated workflows, digital forms, and structured portals—so new hires ramp faster 3X quicker.Trusted by industry leaders in every sector