The Marriage of WOTC and Paperless Onboarding

Cut onboarding time

by 60%—here's the

Ultimate Checklist

that helped do it.

Cut onboarding time

by 60%—here's the

Ultimate Checklist

that helped do it.

Life can be sweet when amazing things go naturally together. Once you’ve enjoyed them, you can’t imagine living without them. Think about it for a minute.

Bread and butter. Coffee and cream. Bacon and eggs.

Simon and Garfunkel.

You can’t enjoy one without also wanting the other.

We recently discovered two more amazing things that go together. They go together so well, in fact, every employer should at least give them a try. I’m talking about the Work Opportunity Tax Credit (aka WOTC, pronounced Watt-See) and paperless onboarding for new employees. They are a perfect match. They sing in perfect harmony. Let me tell you why.

WOTC is For You (and me)

The WOTC Program is a well-known tax benefit for employers. It reduces employers’ federal income tax when they hire veterans, the unemployed and others experiencing economic distress. Most employers already hire people who would qualify. So, if your company isn’t using WOTC, you are (emphasis on “right now”) overpaying your taxes.

How significantly? Depending on why they qualify, one eligible hire can generate anywhere from $1,200 to $9,600 in WOTC tax credits for their new employer. In companies that hire dozens, hundreds or even thousands of employees annually, the tax benefits stack up quickly. It is common for 10 to 20 percent of new hires to qualify as members of a WOTC target group even without changing a company’s usual recruiting practices.

Like any tax benefit, however, there are forms to be filed and hoops through which we must jump. And it must begin at the time of hire. That is where paperless onboarding strolls in like a hero.

Simplify the New-Hire Paper Chase, Like a Hero!

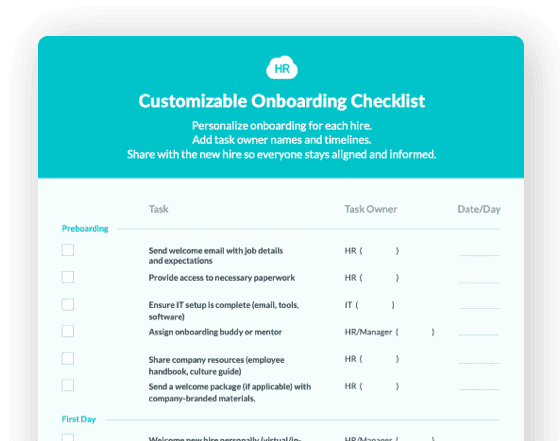

Paperless onboarding helps to solve many problems faced by human resource departments. Simplifying the new-hire paper chase is just one of its many benefits. Cloud-based onboarding does more than get electronic signatures. It gives the onboarding process new order and a stiffer backbone to enforce that order.

The employee does not even have to appear in the office. Since it is cloud-based, new hires can complete their “paperwork” from the comfort of their own computer.

We’re talking about the W-4, Form I-9, direct deposit, an endless variety of employer policies, and even benefits enrollment. We’re also talking about new-employee training activities and video presentations. A robust paperless onboarding system can do it all.

The system requires new employees to complete and electronically sign each form before they can move on to the next. It also collects and digitizes employee information, making that data available for payroll and other management systems.

Finally, paperless onboarding frees the hiring manager’s time and attention. No longer must human resource departments shepherd their new hires through every task, form and signature. And the system reports back, letting HR know when each task has been completed.

The Benefits of WOTC and Paperless Onboarding

When you integrate the WOTC process with paperless onboarding, you have a marriage made in tax-credit heaven. Bringing these amazing things together produces offspring in the form of increased profits.

How?

WOTC done the old fashion way -- with paper -- often falls short. HR departments sometimes struggle to get all the forms completed and submitted on time. Tax benefits can be lost. And all that together means you unnecessarily pay a lot more money to the IRS.

Combining WOTC screening with a paperless onboarding system produces immediate and impressive results. The system automatically captures WOTC forms and signatures from every new hire. When compliance with tax credit screening is improved, tax benefits increase by the same measure.

The reduction of income tax that WOTC provides will often pay for -- actually, more than pay for -- the cost of the paperless onboarding system supporting it. In other words, because WOTC lowers business taxes, employers can make money by enrolling these services together. The result can be more profit and a greener bottom line after taxes.

What Can You Do About It Now?

If this discussion has captured your interest, your next step is easy. HR Cloud and WOTC Planet have integrated their paperless Onboard and WOTC Planet products. These are definitely two great things that go great together.

Gives us a call. Send us an email. We’ll answer your questions and give you a well-thought-out estimate of your company’s potential tax benefit.

For more information on the WOTC process and how it could benefit your business, contact us here.

HR Cloud is a leading developer of HR software & HRMS solutions for small and medium size businesses that have high turnover. HR Cloud's Onboard is market leading technology for effective new hire onboarding and Workmates enables employee engagement simply and easily. Founded in 2012, our HRIS empowers teams to easily onboard new hires, manage employee data, create a company social network and support employee development.

Keep Reading

AI for Frontline HR: Moving Beyond Sentiment Analysis to Build Tomorrow's Workforce Management Engine

TL;DR: While most organizations limit artificial intelligence in human resources to basic

Best HR Tools for Compliance Automation (and Why HR Cloud Leads the Pack)

The Compliance Catch-Up: What HR Needs to Fix Before Mid-Year Audits

By May, most HR teams have settled into the rhythm of the year. But compliance? That

Like What You Hear?

We'd love to chat with you more about how HR Cloud® can support your business's HR needs. Book Your Free Demo

Build a Culture of Recognition. Boost Engagement. Guaranteed.

Workmates empowers employees to stay informed, connected, and appreciated—whether they’re on the front line, in the office, or remote. Recognition drives 12x higher engagement.Trusted by industry leaders in every sector

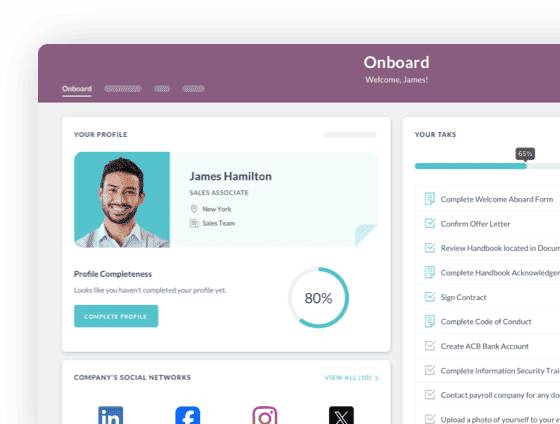

Cut Onboarding Costs by 60%.

Take the confusion and follow-ups out of onboarding with automated workflows, digital forms, and structured portals—so new hires ramp faster 3X quicker.Trusted by industry leaders in every sector