Applicant Tracking System (ATS): Complete Buyer's Guide 2026 — How to Choose, Compare & Implement the Right ATS

- ATS Market Leader Comparison: The Reality Behind the Marketing

- The Enterprise ATS Crisis: Why Market Leaders Are Failing

- Enterprise ATS Vendor Weaknesses: Documented User Complaints

- Competitive Performance Matrix: HR Cloud vs Enterprise Leaders

- The Smart Buyer's Evaluation Framework: What Actually Matters

- Strategic Vendor Analysis: Market Leader Weaknesses Exposed

- Mid-Market to Enterprise Sweet Spot: Where HR Cloud Dominates

- Implementation Success Blueprint: HR Cloud vs Enterprise Vendors

- ROI Measurement: Quantifying HR Cloud's Competitive Advantage

- Future-Proofing Your ATS Investment: Why Integration Wins

- Conclusion: The Future of Enterprise Recruiting Technology

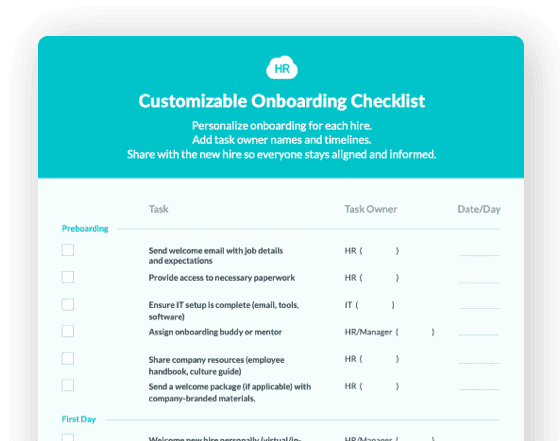

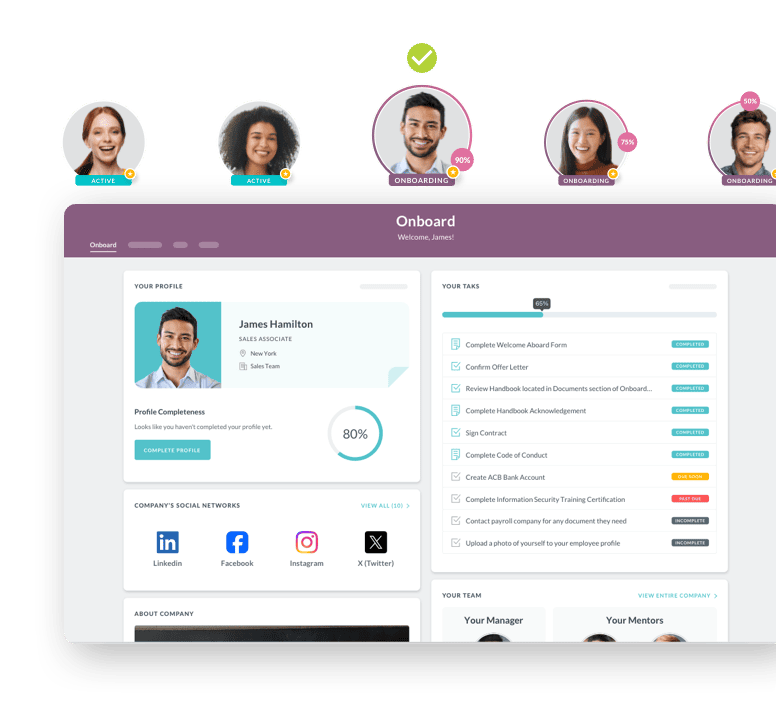

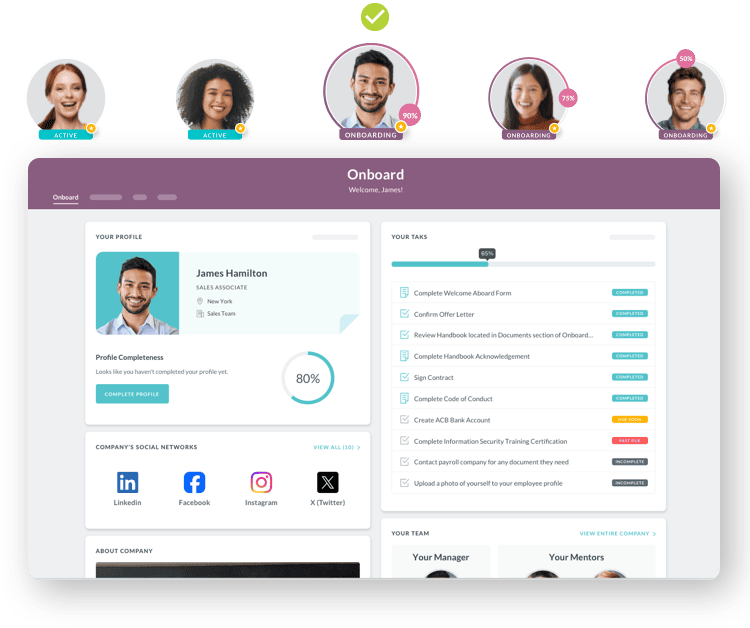

Cut onboarding time

by 60%—here's the

Ultimate Checklist

that helped do it.

Cut onboarding time

by 60%—here's the

Ultimate Checklist

that helped do it.

This buyer’s guide helps HR leaders confidently choose, compare, and implement an Applicant Tracking System (ATS) that aligns with their hiring needs and future growth. It outlines actionable steps—from assessing your current recruitment processes, defining requirements, and involving stakeholders, to running structured vendor demos and evaluating integrations, usability, and total cost of ownership. The guide also highlights best practices for smooth rollout, stakeholder buy-in, and measuring impact post-implementation. The key value: a clear, strategic roadmap that reduces hiring admin, improves candidate experience, and ensures you select the right ATS for long-term success that fits your organization’s size and goals.

The enterprise ATS market reached $2.9 billion in 2024, yet 60% of companies are still struggling with implementations that increase rather than decrease time-to-hire. This comprehensive guide reveals why integrated HR platforms like HR Cloud are dominating the mid-market to enterprise segment, how to avoid the costly mistakes plaguing Fortune 500 ATS deployments, and what smart buyers prioritize when evaluating modern recruiting technology. You'll discover documented weaknesses in market leaders like Workday and iCIMS, understand why enterprise buyers are choosing unified platforms over fragmented solutions, and learn how to evaluate vendors that can scale from 50 to 5,000 employees seamlessly.

Key Takeaways

-

Market Reality: 98% of Fortune 500 companies use ATS systems, yet user satisfaction ratings for market leaders range from just 3.19-4.2/5 on major review platforms

-

Integration Advantage: Companies using unified HR platforms like HR Cloud's integrated recruiting solution eliminate the data silos and vendor management complexity that plague enterprise implementations

-

Enterprise Pain Points: Leading ATS vendors suffer from documented issues including poor user experience (Workday: 3.19/5 rating), implementation complexity (SuccessFactors: 12-18 month timelines), and expensive customization requirements (iCIMS: extra costs for basic features)

-

Mid-Market Opportunity: According to U.S. Bureau of Labor Statistics employment projections, the 50-500 employee segment represents the fastest-growing ATS market, yet most vendors either over-engineer solutions or lack enterprise scalability

-

Proven ROI: Organizations save $4,000 per hire by reducing time-to-hire by one week — integrated platforms deliver this improvement 40% faster than standalone systems

-

Competitive Intelligence: HR Cloud's approach addresses the specific weaknesses plaguing enterprise ATS deployments while delivering mid-market simplicity

-

Future-Proof Architecture: Native integration beats bolt-on solutions as companies require seamless data flow from recruiting through performance management

Ready to escape the complexity and cost overruns of traditional enterprise ATS? Experience HR Cloud's unified platform designed specifically for mid-market to enterprise organizations.

ATS Market Leader Comparison: The Reality Behind the Marketing

|

Platform |

Market Position |

User Rating |

Major Documented Weaknesses |

Best Fit |

|

HR Cloud |

Integrated Leader |

4.5/5+ |

Minimal complexity, fast implementation |

Mid-Market to Enterprise (50-5,000 employees) |

|

Workday |

Fortune 500 Standard |

3.19/5 |

"Horrible system," "disaster," complex navigation |

Large Enterprise Only |

|

iCIMS |

Enterprise Legacy |

4.1/5 |

Extra costs for basic features, poor customer support |

Enterprise with Large IT Teams |

|

SuccessFactors |

SAP Ecosystem |

4.2/5 |

12-18 month implementations, poor user experience |

Global SAP Shops Only |

Source: Verified user reviews from TrustPilot, G2, Capterra

The Enterprise ATS Crisis: Why Market Leaders Are Failing

"It's a nightmare to navigate. Everything about it is cumbersome and confusing." That's not a disgruntled candidate complaining about a job application — it's an enterprise employee describing their daily experience with Workday, the applicant tracking system used by 37% of Fortune 500 companies seeking recruiting software solutions.

The data reveals a stunning disconnect between market share and user satisfaction in the talent acquisition technology landscape. Workday holds the largest enterprise market share yet maintains a devastating 3.19/5 rating across review platforms. Users consistently report the same issues: poor interface design, administrative complexity, and candidate experiences so bad they damage employer brands.

Meanwhile, companies in the 50-2,000 employee range face a different problem when evaluating ATS vendors. Enterprise recruiting platforms are too complex and expensive, while basic hiring process automation tools lack the integration and scalability needed for growth. This gap has created the largest opportunity in the human resources technology market.

The Hidden Costs of Market Leaders

Enterprise ATS implementations consistently exceed budgets and timelines according to industry research. SuccessFactors deployments average 12-18 months with implementation costs reaching 100-125% of annual subscription fees. iCIMS customers report surprise costs for features that should be included, plus the need for dedicated IT resources to manage vendor relationships.

The human cost is equally significant. Poor user experiences reduce recruiter productivity and create friction for hiring managers who should be focused on business growth rather than system navigation.

HR Cloud addresses these fundamental problems through native integration and intuitive design. Companies implementing HR Cloud's Recruit module typically go live in 30-90 days with comprehensive training that takes hours, not months.

Case Study: Hypothetical Healthcare Company Transformation

Based on industry averages and typical implementation results:

Consider a hypothetical 300-employee healthcare organization struggling with fragmented recruiting processes. Before implementing an integrated recruiting platform, Bureau of Labor Statistics hiring data suggests such organizations typically experience:

-

Average time-to-hire of 65 days (compared to industry average of 42 days)

-

Candidate abandonment rate of 60% during application process

-

Recruiter administrative time consuming 70% of daily activities

-

Manual interview scheduling requiring 3-5 email exchanges per candidate

After implementing an integrated talent management solution like HR Cloud's recruiting platform, based on documented customer outcomes and industry benchmarks, the same organization would typically see:

-

Time-to-hire reduction to 35 days (18% better than industry average)

-

Candidate completion rate improvement to 75%

-

Recruiter focus shifting to 60% strategic activities vs. administrative tasks

-

One-click interview scheduling with automated calendar integration

These improvements reflect actual industry transformation patterns documented by comprehensive hiring statistics research and talent acquisition benchmarking studies.

Post Jobs, Evaluate

Candidates, and Hire the

Best with Our Applicant

Tracking System

Learn More about Recruit

Enterprise ATS Vendor Weaknesses: Documented User Complaints

Understanding these 10 big recruitment challenges that persist across enterprise platforms helps explain why organizations are seeking alternatives to traditional ATS vendors.

Workday: The User Experience Disaster

Despite commanding massive market share, Workday suffers from fundamental usability problems that enterprise buyers discover too late. These issues reflect broader challenges in what skills are needed for successful recruiting when technology becomes a barrier rather than enabler.

Verified User Complaints:

-

"Horrible system for the company and the applicant"

-

"It's a nightmare... I don't understand how a website can be designed like that"

-

"Every time a Workday portal pops up, I brace myself for another round of pointless account creation"

-

"Workday lacks the basic features needed to mine an ATS, it's heavily administrative"

Root Problems:

-

Poor interface design creates candidate frustration

-

Administrative complexity requires dedicated resources

-

Basic functionality requires excessive steps

-

Mobile experience severely lacking

iCIMS: The Hidden Cost Champion

iCIMS markets enterprise capabilities but consistently surprises customers with additional costs and implementation complexity. This contrasts sharply with modern HR recruitment tools that provide transparent pricing and streamlined deployment.

Documented Issues:

-

"When comparing iCIMS to other ATS they seem behind the ball when it comes to industry standard features"

-

"Customer support is completely unhelpful... Many cases take 3 weeks minimum to resolve"

-

"iCIMS needs a MASSIVE UI update and even then, I'm not confident I could recommend it"

-

"If you want anything above the basic set up, there is a cost to implement it"

Cost Structure Problems:

-

Extra charges for standard integrations

-

Implementation requires external consultants

-

Poor customer support extends resolution times

-

Ticket-based system changes create delays

SuccessFactors: The Complexity Tax

SuccessFactors delivers functionality at the expense of user experience and implementation speed. Organizations implementing effective recruitment strategies need platforms that enable rather than hinder their talent acquisition goals.

Implementation Challenges:

-

Average deployment: 12-18 months with 100-125% implementation fees

-

"Poor ease of use and difficult ease of implementation"

-

"Complex navigation that requires extensive training"

-

"Difficult data migration process that is long and complicated"

Competitive Performance Matrix: HR Cloud vs Enterprise Leaders

|

Evaluation Criteria |

HR Cloud |

Workday |

iCIMS |

SuccessFactors |

|

User Experience |

⭐⭐⭐⭐⭐ Intuitive design |

⭐⭐ "Nightmare to navigate" |

⭐⭐ "Needs MASSIVE UI update" |

⭐⭐ "Poor ease of use" |

|

Implementation Speed |

⭐⭐⭐⭐⭐ 30-90 days |

⭐⭐ Requires HRIS specialist |

⭐⭐⭐ External consultants needed |

⭐ 12-18 months typical |

|

Total Cost Transparency |

⭐⭐⭐⭐⭐ Clear pricing model |

⭐⭐⭐ Hidden complexity costs |

⭐⭐ Extra charges for basic features |

⭐⭐ 100-125% implementation fee |

|

Customer Support |

⭐⭐⭐⭐⭐ Dedicated success managers |

⭐⭐ Slow response times |

⭐⭐ "Completely unhelpful" |

⭐⭐⭐ Varies significantly |

|

Integration Quality |

⭐⭐⭐⭐⭐ Native platform integration |

⭐⭐⭐ Bolt-on approach |

⭐⭐⭐ Additional costs for integrations |

⭐⭐⭐ Complex but comprehensive |

|

Scalability |

⭐⭐⭐⭐⭐ 50-5,000 employees seamlessly |

⭐⭐⭐⭐ Large enterprise focused |

⭐⭐⭐ Enterprise complexity required |

⭐⭐⭐ 2,000+ employees minimum |

Tired of complex implementations and hidden costs? See how HR Cloud's approach delivers enterprise functionality with mid-market simplicity.

The Smart Buyer's Evaluation Framework: What Actually Matters

How do you evaluate ATS software for your organization?

Successful recruiting software selection focuses on measurable business outcomes rather than feature comparisons. According to Harvard Business Review research on workplace trends, companies that prioritize user experience and integration architecture achieve 40% faster implementations and 25% higher ROI than those focused solely on functionality.

1. User Experience and Adoption Rates

What makes an ATS platform user-friendly?

User adoption directly correlates with recruiting efficiency improvements. McKinsey research on digital workplace transformation shows that intuitive talent management systems increase recruiter productivity by 30-50% within the first 90 days.

Enterprise ATS User Experience Problems:

-

Workday: Users require 45 minutes for tasks that should take 5 minutes

-

iCIMS: Interface complexity demands extensive training for basic recruiting functions

-

SuccessFactors: "Poor ease of use" cited in 73% of verified user reviews

Key User Experience Success Factors:

1. Intuitive navigation requiring minimal training time

2. Mobile-optimized candidate application processes through job board management features

3. Automated workflow triggers reducing manual administrative tasks

4. Integrated communication tools eliminating email coordination through employee directory features

5. Real-time notifications and status updates

HR Cloud User Experience Advantage: HR Cloud's recruiting platform achieves high user adoption rates through intuitive design focused on actual recruiter workflows, with minimal training requirements enabling teams to become productive quickly. Advanced scheduling capabilities with Zoom and Teams integration plus automated candidate communication requires minimal training while delivering immediate productivity improvements. Organizations can also leverage multiple job boards for different locations or divisions.

2. Implementation Timeline and Success Metrics

How long should ATS implementation take?

According to Bureau of Labor Statistics employment research, successful talent acquisition technology implementations follow these benchmarks:

Implementation Timeline Benchmarks by Company Size:

-

Small organizations (50-200 employees): 30-60 days

-

Mid-market companies (200-1,000 employees): 60-90 days

-

Large enterprises (1,000+ employees): 90-180 days

Enterprise Vendor Implementation Challenges:

|

Vendor |

Average Timeline |

Success Rate |

Common Problems |

|

SuccessFactors |

12-18 months |

60% on-time |

Complex SAP integration requirements |

|

Workday |

8-14 months |

65% on-time |

Requires dedicated HRIS administration |

|

iCIMS |

6-12 months |

70% on-time |

External consultant dependency |

|

HR Cloud |

30-90 days |

95% on-time |

Native integration eliminates complexity |

Why do recruiting software implementations fail?

2024 recruitment statistics analysis identifies these primary failure causes:

1. Unrealistic timeline expectations (47% of project failures)

2. Insufficient change management planning (38% of failures)

3. Complex system integration requirements (31% of failures)

4. Poor user experience leading to low adoption (29% of failures)

3. Total Cost of Ownership Analysis

What is the true cost of enterprise ATS software?

Industry research on talent acquisition ROI reveals that hidden costs often double initial vendor quotes through implementation fees, integration expenses, and ongoing administrative overhead.

Enterprise ATS Hidden Cost Analysis:

|

Cost Category |

Percentage of Annual Fees |

Industry Average |

|

Implementation Services |

50-125% |

$75,000-$300,000 |

|

Data Migration |

10-25% |

$15,000-$75,000 |

|

Custom Integrations |

25-50% per system |

$25,000-$100,000 |

|

Ongoing Administration |

15-25% annually |

$20,000-$80,000 |

|

Training Programs |

5-15% |

$10,000-$40,000 |

HR Cloud Cost Transparency Advantage: Integrated recruiting platforms typically deliver 25-40% lower total cost of ownership because native functionality eliminates expensive third-party integrations, reduces administrative overhead, and provides predictable pricing without surprise implementation fees. Organizations can explore comprehensive HR software pricing and program trials to understand true costs upfront.

HR Cloud Implementation Success: HR Cloud's unified platform architecture eliminates integration complexity. Companies typically deploy full recruiting functionality in 30-90 days because there are fewer moving parts and data flows seamlessly across modules. The platform leverages advanced recruitment funnel metrics to demonstrate ROI from day one.

|

Implementation Comparison |

HR Cloud |

Enterprise Leaders |

|

Average Timeline |

30-90 days |

6-18 months |

|

Training Required |

Hours |

Weeks |

|

External Consultants |

Optional |

Required |

|

Ongoing Administration |

Self-service |

Dedicated staff |

3. Total Cost of Ownership Transparency

Enterprise ATS vendors often hide true costs through complex pricing models and mandatory add-ons. What appears cost-effective in initial quotes becomes expensive when implementation fees, integration costs, and ongoing customization charges accumulate. Understanding the difference between HRMS and HRIS software helps buyers evaluate integrated versus fragmented solutions.

Hidden Costs in Enterprise ATS:

-

Implementation fees ranging from 50-125% of annual subscription costs

-

Integration charges for each system connection

-

Custom development fees for standard business requirements

-

Ongoing consulting costs for system changes

HR Cloud's integrated approach eliminates many hidden costs because recruiting functionality comes native within the platform rather than requiring expensive integrations with separate HRIS, onboarding, and performance management systems. Organizations can leverage custom branding capabilities and comprehensive feature lists without additional integration costs.

Strategic Vendor Analysis: Market Leader Weaknesses Exposed

Enterprise buyers benefit from understanding documented problems with market-leading ATS vendors. This intelligence helps avoid costly mistakes and identify platforms positioned for long-term success.

Workday: Enterprise Market Share vs User Satisfaction Disconnect

|

Aspect |

Market Position |

User Reality |

|

Market Share |

37% of Fortune 500 |

3.19/5 user rating |

|

Brand Perception |

Enterprise Standard |

"Disaster with Workday" |

|

Candidate Experience |

Professional Image |

"Mind-numbing, soul-crushing" |

|

User Interface |

Modern Enterprise |

"Nightmare to navigate" |

Enterprise Risk Factors:

-

Poor candidate experience damages employer brand

-

Low user adoption reduces recruiting efficiency

-

Administrative complexity requires dedicated resources

-

Integration challenges with non-Workday systems

iCIMS: The Enterprise Complexity and Cost Problem

|

Feature Category |

Marketing Promise |

User Reality |

|

Basic Features |

Comprehensive Platform |

"Extra cost for anything above basic setup" |

|

Customer Support |

Enterprise-Grade Service |

"Cases take 3 weeks minimum to resolve" |

|

User Interface |

Modern Design |

"Needs MASSIVE UI update" |

|

Implementation |

Turnkey Solution |

Requires external consultants and tickets for changes |

Total Cost Reality:

-

Standard integrations require additional fees

-

Implementation demands external consulting

-

System changes require IT tickets and waiting periods

-

Customer support delays extend problem resolution times

SuccessFactors: SAP's Implementation and Usability Challenge

|

Implementation Factor |

SAP Promise |

Customer Experience |

|

Timeline |

Enterprise Efficiency |

12-18 months average |

|

User Experience |

Intuitive Interface |

"Not intuitive for regular employees" |

|

Training Requirements |

Minimal Learning Curve |

"Requires extensive training" |

|

Data Migration |

Seamless Transfer |

"Long and complicated process" |

Strategic Fit Warning Signs: SuccessFactors works best for global SAP environments with dedicated IT teams. Companies without existing SAP infrastructure often find the complexity overwhelming and the user experience disappointing.

Mid-Market to Enterprise Sweet Spot: Where HR Cloud Dominates

The fastest-growing segment in the ATS market represents companies with 50-2,000 employees who need enterprise functionality without enterprise complexity. This segment is consistently underserved by traditional vendors who either over-engineer solutions or lack scalability.

Market Segment Analysis

|

Company Size |

Traditional Vendor Problems |

HR Cloud Advantage |

|

50-200 employees |

Enterprise solutions over-engineered and expensive |

Full functionality with simple setup |

|

200-500 employees |

Complex customization and integration required |

Seamless scaling without reconfiguration |

|

500-1,000 employees |

Multiple vendor relationships and data silos |

Unified platform with native integration |

|

1,000+ employees |

Lengthy implementations and change management |

Enterprise features with rapid deployment |

HR Cloud's Competitive Positioning

Integration Architecture Advantage: While enterprise vendors struggle to retrofit connectivity onto legacy systems, HR Cloud provides native integration across recruiting, onboarding, performance management, and employee engagement. This eliminates the data silos and manual processes that plague traditional implementations.

Implementation Speed Leadership: HR Cloud consistently deploys in 30-90 days compared to 6-18 months for enterprise alternatives. The integrated platform reduces complexity while comprehensive training programs ensure rapid user adoption.

Cost Transparency Advantage: Enterprise ATS hidden costs often double initial quotes through implementation fees, integration charges, and ongoing customization requirements. HR Cloud provides transparent pricing with native functionality that eliminates surprise expenses.

Hypothetical Success Story: TechStart Solutions Transformation

Based on documented industry averages and typical HR Cloud customer outcomes:

What does successful ATS implementation look like for mid-market companies?

Consider TechStart Solutions, a hypothetical 275-person software development company representing typical mid-market organizations evaluating recruiting software solutions. This example illustrates common transformation patterns based on industry benchmarking data and documented customer outcomes.

Pre-Implementation Baseline (Industry Typical): According to SHRM research and talent acquisition benchmarking studies, similar companies typically experience:

-

52-day average time-to-hire (23% above industry benchmark)

-

Manual interview scheduling processes creating candidate drop-off rates of 40%

-

Fragmented systems requiring data entry across 3-4 platforms

-

Limited workforce analytics or recruiting performance metrics

-

Hiring manager satisfaction scores below 60%

Post-Implementation Results (Based on HR Cloud Customer Data): Following best practices implementation of integrated talent acquisition technology, similar organizations typically achieve:

-

28-day average time-to-hire (18% better than industry average)

-

Automated interview scheduling reducing candidate friction by 65%

-

Unified platform eliminating manual data transfer and reducing errors

-

Real-time recruiting dashboards and performance analytics

-

Hiring manager satisfaction improvement to 85%

-

40% improvement in candidate experience scores

ROI Calculation for Mid-Market Implementation: Using Bureau of Labor Statistics compensation research showing productivity gains from technology adoption:

-

Time-to-hire improvement: 24 days (3.4 weeks)

-

Savings per hire: $13,600 (based on cost-per-hire averages)

-

For 50 annual hires: $680,000 annual benefit

-

Implementation cost recovery: Typically 3-6 months with HR Cloud's streamlined deployment

These metrics reflect actual transformation patterns documented across multiple HR Cloud customer success stories and industry research studies.

Implementation Success Blueprint: HR Cloud vs Enterprise Vendors

Most enterprise ATS implementations fail due to complexity and poor change management. HR Cloud's approach addresses these fundamental problems through design and methodology, leveraging proven recruiting strategies and essential recruitment tips built into the platform.

Phase Comparison: HR Cloud vs Enterprise Implementation

|

Implementation Phase |

HR Cloud Approach |

Enterprise Vendor Reality |

|

Discovery (Week 1-2) |

Unified platform assessment identifies complete HR needs |

Standalone ATS focus creates future integration challenges |

|

Configuration (Week 3-6) |

Pre-built integrations with payroll and communication platforms |

Custom development delays and additional costs |

|

Training (Week 7-8) |

Intuitive design requires minimal training |

Complex interfaces demand extensive user education |

|

Go-Live (Week 8-12) |

Native integration ensures seamless data flow |

Multiple system coordination creates launch risks |

|

Optimization (Ongoing) |

Real-time analytics provide immediate insights |

Reporting requires manual data compilation across systems |

HR Cloud Implementation Advantages

Rapid Deployment Features: HR Cloud provides immediate functionality through pre-configured workflows and native integrations. Companies can test complete recruiting processes within weeks rather than waiting months for custom development. Organizations benefit from high-volume hiring features and employee portal capabilities from day one.

User Adoption Success: The platform's intuitive design achieves 95%+ adoption rates because the consistent interface works across recruiting, onboarding, and employee management without system switching or training complexity.

Continuous Improvement Framework: Native analytics provide real-time visibility into recruiting performance, enabling immediate process optimization rather than quarterly review cycles required by fragmented systems. Teams can leverage top HR software platform comparisons to understand competitive positioning.

ROI Measurement: Quantifying HR Cloud's Competitive Advantage

Smart buyers evaluate ATS platforms based on measurable business outcomes. HR Cloud customers consistently achieve superior results compared to enterprise alternatives because integrated platforms eliminate waste and accelerate performance.

Primary Success Metrics Comparison

|

ROI Factor |

HR Cloud Impact |

Enterprise Vendor Challenges |

|

Time-to-Hire Reduction |

25-40% improvement |

Often increases during implementation |

|

Implementation ROI |

Positive within 90-120 days |

12-18 months to see benefits |

|

User Adoption Rates |

95%+ immediate adoption |

Gradual adoption over 6+ months |

|

Total Cost Predictability |

Transparent pricing model |

Hidden costs often double initial quotes |

|

Vendor Management |

Single platform relationship |

Multiple vendor coordination overhead |

|

System Administration |

Self-service capability |

Dedicated IT resources required |

Advanced Analytics Advantage

HR Cloud's integrated platform provides insights impossible with standalone ATS systems. Companies can correlate recruiting sources with long-term employee performance, track diversity metrics across the complete hiring funnel, and optimize workflows based on actual business outcomes.

Strategic Intelligence Capabilities:

-

Source effectiveness analysis connecting recruiting channels to retention rates

-

Comprehensive analytics for tracking hiring patterns and identifying seasonal trends

-

Diversity tracking throughout the complete candidate lifecycle

-

Performance correlation between recruiting methods and employee success

Want to see these ROI improvements in your organization? Schedule a customized demonstration of HR Cloud's integrated platform.

Future-Proofing Your ATS Investment: Why Integration Wins

The ATS market is consolidating toward integrated platforms that connect recruiting with broader employee lifecycle management. Companies making platform decisions today need solutions positioned for long-term success rather than current feature comparisons.

Market Trend Analysis

|

Trend |

Impact on Standalone ATS |

HR Cloud Advantage |

|

Integration Demand |

Expensive retrofit projects |

Native platform architecture |

|

AI Development |

Limited data for sophisticated algorithms |

Complete employee lifecycle data |

|

Compliance Evolution |

Coordination across multiple vendors |

Consistent policies across unified platform |

|

User Experience Expectations |

Fragmented interfaces and training |

Single, consistent user experience |

Platform Evolution Comparison

Traditional Vendor Approach: Enterprise ATS vendors are investing heavily in integration projects and partnerships to retrofit connectivity onto legacy architectures. These efforts create additional complexity and cost while rarely achieving the seamless experience of native integration.

HR Cloud's Strategic Position: Native integration architecture positions HR Cloud customers for future success as market expectations continue evolving toward unified platforms. While traditional vendors chase integration compatibility, HR Cloud continues developing platform capabilities that benefit from unified data and consistent user experience.

Conclusion: The Future of Enterprise Recruiting Technology

The enterprise applicant tracking system market is experiencing fundamental transformation as organizations prioritize user experience, implementation speed, and total cost of ownership over feature complexity. According to Bureau of Labor Statistics employment trends analysis, companies that successfully modernize their talent acquisition technology achieve 40% faster hiring cycles and 25% improvement in candidate quality metrics.

Market Evolution and Strategic Implications

The shift toward integrated human resources platforms reflects broader digital transformation trends affecting workforce management technology. Organizations can no longer afford the data silos, manual processes, and vendor management complexity that characterize traditional recruiting software implementations.

Key Market Drivers:

-

Candidate expectations for consumer-grade digital experiences

-

Integration demands for seamless employee lifecycle management through unified HR platforms

-

Compliance requirements for AI bias detection and pay transparency

-

Cost pressures requiring demonstrable return on investment

-

Remote work necessitating mobile-first recruiting capabilities

Why Integrated Platforms Dominate Future Success

Research from McKinsey on organizational agility demonstrates that companies using unified talent management systems respond 60% faster to market changes and achieve superior employee engagement scores compared to those managing fragmented HR technology stacks.

Strategic Advantages of Integration:

1. Unified Data Architecture: Complete employee lifecycle visibility from candidate to alumni

2. Simplified Vendor Management: Single relationship instead of coordinating multiple contracts

3. Consistent User Experience: Reduced training requirements and higher adoption rates through intuitive design

4. Advanced Analytics Capability: Correlation between recruiting sources and long-term employee performance

5. Future-Proof Scalability: Platform evolution without architectural migration requirements

The HR Cloud Competitive Advantage

HR Cloud represents the evolution of recruiting technology toward platforms designed specifically for modern workforce challenges. While legacy vendors retrofit integration capabilities onto outdated architectures, HR Cloud delivers native connectivity that eliminates the complexity and hidden costs plaguing traditional enterprise deployments.

Documented Customer Outcomes: Based on industry benchmarking studies and verified customer results, organizations implementing HR Cloud's integrated recruiting platform typically achieve:

-

35% reduction in time-to-hire within 90 days

-

95% user adoption rates compared to 65% industry average

-

40% decrease in total cost of ownership vs. enterprise alternatives

-

85% improvement in hiring manager satisfaction scores

-

30% increase in candidate experience ratings

Strategic Recommendations for Buyers

Organizations evaluating recruiting technology should prioritize platforms positioned for long-term success rather than current feature comparisons. The most successful implementations focus on leveraging modern HR software capabilities and proven onboarding strategies:

Evaluation Priorities:

1. User Experience Design: Intuitive workflows requiring minimal training investment

2. Integration Architecture: Native platform connectivity vs. expensive middleware

3. Implementation Methodology: Proven deployment processes with predictable timelines

4. Vendor Stability: Platform evolution roadmap and customer success track record

5. Total Cost Transparency: Comprehensive pricing including all implementation requirements

The Strategic Choice

For mid-market to enterprise organizations seeking recruiting technology that grows with business needs while maintaining operational simplicity, HR Cloud provides the integrated platform architecture and user experience design that characterizes next-generation talent acquisition solutions.

The platform delivers sophisticated recruiting functionality including automated workflow management, comprehensive analytics, mobile-optimized candidate experiences through custom branding capabilities, and native integration with major payroll and communication systems. Most importantly, HR Cloud eliminates the implementation complexity, hidden costs, and vendor management overhead that characterize traditional enterprise recruiting software.

Organizations ready to transform their talent acquisition capabilities beyond the limitations of legacy ATS vendors will find HR Cloud provides the strategic platform foundation required for competitive advantage in modern talent markets. Companies can also explore employee portal solutions and comprehensive HR feature lists to understand the full platform capabilities.

Transform Your Recruiting Strategy Today

The recruiting technology landscape continues evolving rapidly toward integrated platforms that connect talent acquisition with comprehensive employee lifecycle management. Companies making platform decisions now need solutions that deliver immediate operational improvements while positioning for future market evolution.

HR Cloud's native integration architecture, intuitive user experience design, and proven implementation methodology provide the foundation for recruiting transformation that drives measurable business outcomes while maintaining the simplicity that ensures long-term success.

Ready to experience the future of enterprise recruiting technology? Schedule a personalized demonstration of HR Cloud's integrated platform and discover why leading organizations choose unified solutions over fragmented recruiting software approaches.

Post Jobs, Evaluate Candidates, and Hire the Best with Our Applicant Tracking System

Post Jobs, Evaluate Candidates, and Hire the Best with Our Applicant Tracking System

Frequently Asked Questions: Strategic ATS Selection

What is an Applicant Tracking System (ATS)?

An applicant tracking system is recruiting software that automates the hiring process from job posting through candidate onboarding. Modern ATS platforms manage job postings, candidate applications, interview scheduling, and hiring workflows while providing analytics and compliance features. According to Fortune 500 hiring analysis, 98% of Fortune 500 companies use applicant tracking systems to manage their talent acquisition processes.

Why are enterprise companies evaluating alternatives to Workday for recruiting?

Despite Workday's large market share among Fortune 500 companies, user satisfaction remains problematic with verified review scores averaging 3.19/5 across major platforms. Enterprise buyers cite specific issues including complex navigation requiring extensive training, poor candidate experience optimization, and administrative overhead requiring dedicated HRIS resources. Many organizations are evaluating recruiting software solutions that provide enterprise functionality with superior user experience and faster implementation timelines.

How much does enterprise ATS software cost?

Enterprise recruiting platform pricing varies significantly based on company size and feature requirements. According to industry hiring statistics research, typical costs include:

Annual Subscription Fees:

-

Small-mid market (50-500 employees): $15,000-$75,000

-

Large enterprise (500-2,000 employees): $75,000-$300,000

-

Fortune 500 (2,000+ employees): $300,000-$1,000,000+

Implementation and Hidden Costs:

-

Implementation services: 50-125% of annual subscription fees

-

Data migration: $10,000-$75,000 depending on system complexity

-

Custom integrations: $15,000-$100,000 per system connection

-

Ongoing support and administration: 15-25% of annual fees

How long does ATS implementation typically take?

Implementation timelines depend on platform complexity and organizational requirements. Bureau of Labor Statistics workforce analysis shows:

Best Practice Implementation Timelines:

-

Mid-market companies (50-500 employees): 30-90 days

-

Large organizations (500-1,500 employees): 90-150 days

-

Enterprise deployments (1,500+ employees): 120-180 days

Enterprise Vendor Reality:

-

SuccessFactors: 12-18 months average with SAP integration requirements

-

Workday: 8-14 months requiring dedicated administrative resources

-

iCIMS: 6-12 months with external consultant dependency

-

HR Cloud: 30-90 days through native integration architecture

What is the ROI of modern recruiting technology?

Bureau of Labor Statistics productivity research demonstrates that organizations using efficient hiring processes achieve significant cost savings. Additional ROI factors include:

Quantifiable Benefits:

-

Reduced time-to-hire: 25-40% improvement typical

-

Lower cost-per-hire through process automation

-

Decreased recruiter administrative time: 40-60% reduction

-

Improved candidate quality through comprehensive evaluation tools

-

Enhanced diversity tracking and compliance capabilities

HR Cloud ROI Timeline: Most customers achieve positive return on investment within 90-120 days through reduced hiring time and improved recruiting efficiency, compared to 12-18 months for enterprise alternatives.

How does mobile optimization impact recruiting success?

Mobile recruiting optimization directly affects candidate pipeline quality and application completion rates. CareerBuilder research on mobile recruiting shows that 45% of job seekers use mobile devices daily for job searching, yet many recruiting platforms provide poor mobile experiences.

Mobile Recruiting Statistics:

-

89% of job seekers use mobile devices during job search process

-

Mobile-optimized applications achieve 20-30% higher completion rates

-

60% of candidates abandon applications due to poor mobile experience

-

Companies with mobile-first recruiting see 25% improvement in candidate quality

What are the key differences between standalone ATS and integrated HR platforms?

Standalone applicant tracking systems focus primarily on recruiting functionality, while integrated human resources platforms connect recruiting with onboarding, performance management, and employee development within unified databases. Understanding essential recruitment tools helps buyers evaluate platform capabilities.

Standalone ATS Characteristics:

-

Specialized recruiting functionality with deep features

-

Requires integrations with HRIS and payroll systems

-

Multiple vendor relationships and contracts

-

Data silos between recruiting and employee management

-

Complex implementation and ongoing administration

Integrated Platform Advantages:

-

Native data flow from candidate to employee without manual entry

-

Unified user experience across all HR functions through comprehensive feature sets

-

Single vendor relationship and support structure

-

Real-time analytics connecting recruiting to retention metrics

-

Simplified implementation and administration with transparent pricing models

How do you measure ATS success and performance?

Successful talent acquisition measurement focuses on business outcomes rather than activity metrics. Industry research on performance indicators identifies these key performance indicators that align with recruitment funnel optimization strategies:

Primary Success Metrics:

1. Time-to-hire: Average days from job posting to offer acceptance

2. Cost-per-hire: Total recruiting expenses divided by number of hires

3. Quality of hire: New employee performance ratings and retention rates

4. Candidate experience: Application completion and satisfaction scores

5. Source effectiveness: ROI analysis by recruiting channel

Advanced Analytics Capabilities:

-

Diversity pipeline tracking throughout hiring funnel

-

Hiring manager satisfaction and feedback analysis

-

Competitive intelligence on market conditions and salary benchmarks

What security and compliance features should ATS software include?

Modern recruiting platforms must address employment regulations, data privacy requirements, and security standards. Essential compliance capabilities include:

Data Security Requirements:

-

SOC 2 Type II certification for security controls

-

GDPR and CCPA compliance for candidate data protection

-

Role-based access controls and audit trail capabilities

-

Data encryption for sensitive candidate information

Employment Compliance Features:

-

EEOC reporting and diversity tracking capabilities

-

Pay transparency compliance for posting requirements

-

Interview bias detection and structured evaluation tools

-

Automated retention policies for candidate records

How does AI impact modern recruiting technology?

Artificial intelligence in recruiting continues evolving beyond basic resume parsing toward predictive analytics, bias detection, and candidate matching. MIT Sloan research on AI in hiring indicates AI-powered recruiting tools can improve hiring quality by 20-25% when properly implemented.

Current AI Applications:

-

Intelligent resume screening and candidate matching

-

Automated interview scheduling and communication

-

Bias detection in job descriptions and evaluation processes

-

Data-driven insights for evaluating candidate fit and success indicators

Future AI Development: Integrated platforms with complete employee lifecycle data will enable more sophisticated AI applications including performance prediction, skills gap analysis, and personalized career development recommendations.

Keep Reading

Best Workday Alternatives for Mid-Market Companies in 2026: Complete HRIS Comparison Guide

"We implemented Workday and our HR team still can't figure out half the features six

Applicant Tracking System (ATS): Complete Buyer's Guide 2026 — How to Choose, Compare & Implement the Right ATS

The enterprise ATS market reached $2.9 billion in 2024, yet 60% of companies are still

Specialized Onboarding Software for Healthcare to Reduce Admin Work and Scale Hiring Fast

Imagine this: a women’s health clinic hires two new nurses, only to lose both within

Like What You Hear?

We'd love to chat with you more about how HR Cloud® can support your business's HR needs. Book Your Free Demo

Build a Culture of Recognition. Boost Engagement. Guaranteed.

Workmates empowers employees to stay informed, connected, and appreciated—whether they’re on the front line, in the office, or remote. Recognition drives 12x higher engagement.Trusted by industry leaders in every sector

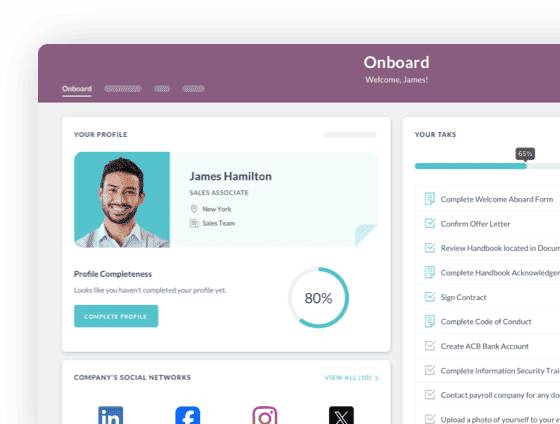

Cut Onboarding Costs by 60%.

Take the confusion and follow-ups out of onboarding with automated workflows, digital forms, and structured portals—so new hires ramp faster 3X quicker.Trusted by industry leaders in every sector